December 2022 foam plastics (EPS) industry production and sales boom index of 98.09

Abstract

1. Production and marketing prosperity index of foam plastics (EPS) industry

In order to intuitively reflect the supply and demand situation and future trend of China's foam (EPS) industry, the China Plastics Processing Industry Association Foam (EPS) Special Committee released the "Foam (EPS) Industry Production and Marketing Prosperity Index" in 2023 ". The index is based on the dynamic data of the National Bureau of Statistics and the General Administration of Customs, combined with the sample data of EPS enterprises selected in the current month, and obtained after modeling and analysis.

3. Prosperity index reference indicators

The main reference indicators of the prosperity index include (in monthly units): domestic sample EPS resin production and sales volume, actual EPS resin import and export volume, current value of international shipping price, data generated by major application ends such as building insulation, buffer packaging, cold chain logistics, raw material cost and proportion of production and processing cost, land transportation price and activity, important events and policy releases inside and outside the industry in the current period, etc, the increase or decrease of the reference basis and the weighted assignment are updated annually.

The "Foam Plastic (EPS) Industry Production and Marketing Prosperity Index" will analyze the industry trend from the direction of changes in the industry's production and marketing prosperity, and give early warnings to the industry's operating conditions, providing reference for the government, industry, enterprises and the public to make decisions.

1.

Summary

In December 2022, the production and sales prosperity index of the foam plastic (EPS) industry dropped significantly, and the decline level was higher than that of the same period last year. In addition to considering the cyclical factors of the industry (flame retardant application turned to the traditional off-season), the downstream market demand contraction constraints were further strengthened. In addition, after the adjustment of the epidemic prevention policy, the first wave of infection peaks appeared in China, which continued to exert downward pressure on the industry production and sales. In December, the central government's policy opinions on real estate and internal cycle consumption were frequent, but the transmission to the industry still needs a longer cycle. The profits of bubble processing enterprises continue to repair, but production and operation activities are more cautious, taking into account the impact of the Spring Festival factors, the market growth rate in January may further decline.

December 2.2022 Index

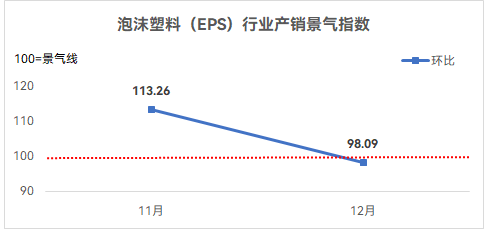

In December 2022, the national foam plastics (EPS) industry production and sales prosperity index was 98.09, down 15.16 points from November, falling below the prosperity line, and the overall production and sales level fell.

3. Impact factors

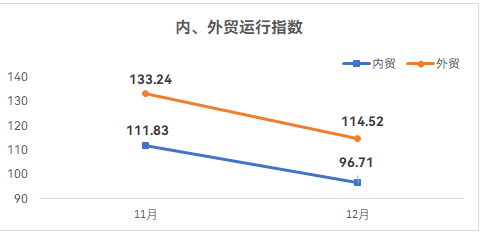

In December, the domestic trade operation index fell to 96.71, affecting the overall level of the prosperity index fell by about 3.05; the foreign trade operation index fell back to 114.52, but still in the boom range, affecting the overall level of the prosperity index rose by about 0.96; the inventory index fell by about 9 percent month-on-month.

4. Domestic trade demand

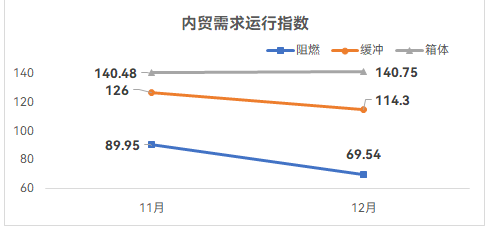

In the operation of domestic trade, the flame retardant demand index fell to 69.54, and the decline expanded, affecting the domestic trade index level to drop by about 7.61. The buffer demand index fell back to 114.3, but it was still in the boom range, affecting the domestic trade index level to rise by about 9%. The box demand index rose to 140.75, rising slightly, affecting the domestic trade index level to rise by about 3.26.

recommend Reading